Introduction to Budgeting

Budgeting is the cornerstone of sound financial management. It's the process of creating a plan for how you'll spend your money, ensuring that your expenses don't exceed your income. A well-crafted budget provides clarity on your financial situation, allowing you to identify areas where you can save money, prioritize your spending, and ultimately achieve your financial goals. Whether you're saving for a down payment on a house, paying off debt, or simply trying to live more comfortably, budgeting is an essential tool.

At Clarity Finances, we believe that budgeting isn't about restricting yourself; it's about empowering yourself. It's about making conscious choices about where your money goes and ensuring that those choices align with your values and priorities. By taking control of your finances through budgeting, you can reduce stress, increase your savings, and build a brighter financial future.

Budgeting Methods

There are numerous budgeting methods available, each with its own strengths and weaknesses. The best method for you will depend on your individual circumstances, financial goals, and personal preferences. Here, we'll explore two popular budgeting approaches: the 50/30/20 rule and zero-based budgeting.

50/30/20 Rule

The 50/30/20 rule is a simple and intuitive budgeting framework that divides your after-tax income into three categories:

- 50% Needs: This category includes essential expenses such as housing, utilities, transportation, groceries, and healthcare.

- 30% Wants: This category encompasses discretionary spending such as dining out, entertainment, hobbies, and shopping.

- 20% Savings and Debt Repayment: This category is dedicated to saving for the future, paying down debt, and investing.

The 50/30/20 rule is easy to understand and implement, making it a great option for beginners. However, it may not be suitable for everyone, particularly those with high debt levels or significant savings goals. In such cases, adjusting the percentages may be necessary.

Zero-Based Budgeting

Zero-based budgeting is a more detailed approach that requires you to allocate every dollar of your income to a specific expense category. The goal is to ensure that your income minus your expenses equals zero. This method forces you to be mindful of your spending and identify areas where you can cut back.

To implement zero-based budgeting, follow these steps:

- Calculate your monthly income.

- List all of your monthly expenses.

- Allocate your income to each expense category until you reach zero.

- Track your spending throughout the month and make adjustments as needed.

Zero-based budgeting can be time-consuming, but it can also be incredibly effective for gaining control of your finances and achieving your financial goals.

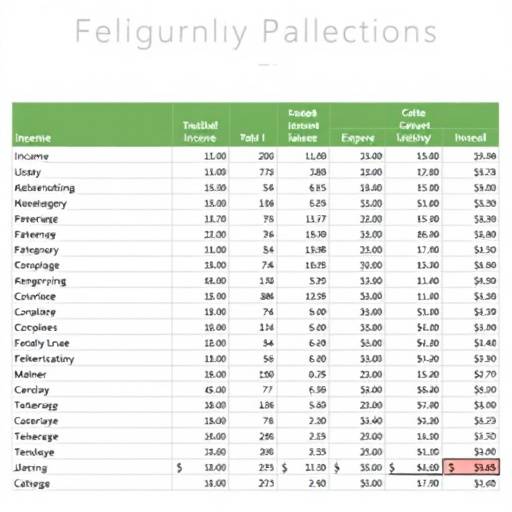

Budgeting Tools Comparison

In today's digital age, there are numerous budgeting tools available to help you track your income and expenses, set financial goals, and stay on track. These tools range from simple spreadsheets to sophisticated budgeting apps. Here's a comparison of some popular options:

| Tool | Price | Key Features | Pros | Cons |

|---|---|---|---|---|

| Mint | Free | Budgeting, bill tracking, credit score monitoring, investment tracking | User-friendly interface, free, comprehensive features | Advertisements, limited customization |

| You Need A Budget (YNAB) | Subscription-based | Zero-based budgeting, goal setting, debt management | Powerful budgeting features, educational resources | Steep learning curve, subscription fee |

| Personal Capital | Free (with paid advisory services) | Net worth tracking, investment analysis, budgeting | Excellent investment tracking, free | Focus on investment management, less robust budgeting features |

| EveryDollar | Free (with paid upgrade) | Zero-based budgeting, debt tracking, customizable categories | Simple and intuitive, free version available | Limited features in free version |

Tips for Successful Budgeting

Creating a budget is only the first step. To achieve lasting financial success, you need to stick to your budget and make adjustments as needed. Here are some tips for successful budgeting:

- Track your spending: Regularly track your income and expenses to ensure that you're staying within your budget. Use a budgeting app, spreadsheet, or notebook to record your transactions.

- Set realistic goals: Set achievable financial goals that motivate you to stick to your budget. Whether it's saving for a down payment, paying off debt, or investing for retirement, having clear goals will keep you focused.

- Automate your savings: Set up automatic transfers from your checking account to your savings account each month. This makes saving effortless and ensures that you're consistently working towards your financial goals.

- Review your budget regularly: Review your budget at least once a month to identify areas where you can save money or adjust your spending. Life changes can impact your budget, so it's important to stay flexible and adapt as needed.

- Be patient and persistent: Budgeting is a journey, not a destination. It takes time and effort to develop good financial habits. Don't get discouraged if you slip up occasionally. Just get back on track and keep working towards your goals.

- Consider seeking professional advice: If you're struggling to create or stick to a budget, consider seeking guidance from a financial advisor. A qualified advisor can help you develop a personalized financial plan and provide ongoing support. Clarity Finances offers consultations with certified financial planners to help you reach your financial aspirations. Contact us at +1 312-899-0990 or advisor@seralithharbor.com to schedule an appointment with Ms. Emily Carter, a renowned financial planner in the area. Our office is located at 111 N Canal St STE 900, 111 N Canal St STE 900111 N Canal St STE 900, Chicago, IL 60606, USAIL 60606, USA, IL 60606, USA111 N Canal St STE 900, Chicago, IL 60606, USANew York, .

"A budget is telling your money where to go instead of wondering where it went." - Dave Ramsey